If you have Bitcoin or other cryptos, you might be wondering: Can I use cryptocurrency…

Answering Your Biggest Real Estate Questions Right Now

The market is unprecedented right now, emerging from a pandemic that changed how we do business. As a result, the real estate market is hot, but headlines have many people scratching their heads on whether it’s time to buy, sell, renovate, or stay put. We know you have questions, so we went ahead and compiled answers to the most burning real estate questions you have right now.

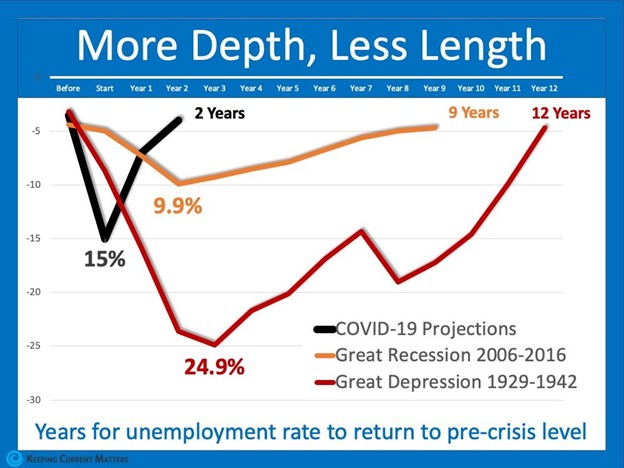

How Long Will it Take the Economy to Recover from COVID-19?

No one can predict how long the effects of COVID-19 will last, and with nothing in recent history to compare it with, economists are stumped on a timeline for economic recovery.

Data released from Goldman Sachs, JP Morgan, and Morgan Stanley predict that the GDP will see a rebound in the third fiscal quarter, with experts saying it will most likely resemble a “V” type recovery. A recent study from John Burns Consulting also noted that past pandemics have also created V-shaped economic recoveries, and had minimal impact on housing prices.

Business owners are also optimistic about a fast turnaround of the economy. A study by PricewaterhouseCoopers found that 90% believe business will return to normal within 1 to 3 months of the pandemics passing. From major financial institutions to business leaders across the U.S., optimism that the economy will bounce back is high, but only time will tell.

Will we emerge from the Post-COVID World in a Recession?

By its technical definition, a recession is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

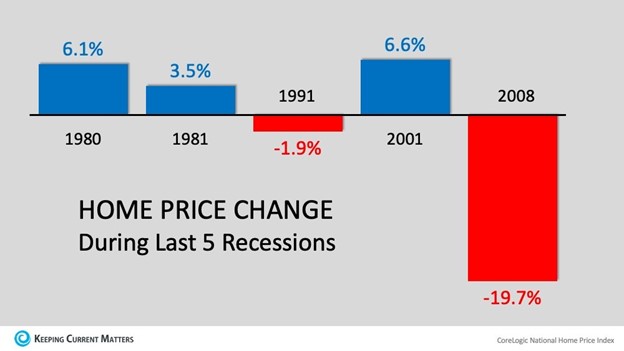

Considering the number of businesses and industries that have had to close trying to flatten the curve of the COVID-19 pandemic, experts believe it is likely we will see a recession – however, it’s important to understand is that a recession does not equal a housing crisis.

If a Recession Happens, Are We Looking at 2008 all Over Again?

The financial collapse that led to the housing crash and the Great Recession of 2008 is still very fresh in American minds. And for that reason, many people associate a recession with a housing crisis.

This is what we know: The factors leading up to the housing bubble were a unique and perfect storm that ultimately led to the financial market collapse.

Risky mortgages, inflated home values, maxed out equity, and excessive inventory led to a wave of short sales and foreclosures that depreciated home values by almost 25%.

However – today’s market looks nothing like 2008.

With American’s holding more equity in their homes, stricter mortgage lending regulations in effect, and an inventory shortage rather than surplus, the housing market is nothing like 2008. This means that real estate is in a strong place despite the turbulent economy right now and will likely bounce back quickly, if it’s affected much at all.

Home values are unlikely to be affected

If we are headed into a recession, it’s important to remember that it doesn’t necessarily mean home values will be affected. For example, Zelman & Associates, a leading housing market analyst, recently updated their home price appreciation estimates for 2021.

Pre-COVID-19, their analysis was that prices would appreciate 4.7% in 2021. Post Covid-19, they are still predicting appreciation, just at a lower rate of 3%.

Will the Post-COVID World Cause a Surge in Foreclosures?

Over 25 million Americans have lost their jobs since mandatory “stay-at-home” orders were put into effect. While this is getting better, many people fear that this will cause a wave of foreclosures circa 2008 that will take down the housing market.

There’s no denying that the massive wave of job losses caused by COVID-19 isn’t serious, but economists believe that the effects won’t be for long. Mortgage companies have taken this unique situation into account, with many offering to defer payments for those affected. Another sign of recovery – CNBC reported that most homeowners have exited forbearance programs. In fact, the need for it is so low that a deadline has been set to end the program – for mortgages backed by FHA/HUD, USDA or VA, the deadline to request initial forbearance is June 30, 2021. Fannie Mae and Freddie Mac have not specified a deadline.

Overall, Americans are in a much better equity situation than they were in 2008, with 37% of homeowners having no mortgage at all. And looking at data from the last 30 years, there appears to be no direct correlation between unemployment rates and home sale rates. For example, unemployment rates have dropped significantly in the past five years while home sales have remained steady.

Should I Buy or Sell a Home Right Now?

All of the above questions ultimately lead to this one. Many Americans have halted their home search or selling plans because of the uncertainty surrounding everything going on right now and the lack of inventory in the real estate market. While the pandemic has disrupted the way we do business, real estate as a whole has not stopped, and homeownership still remains the number one way to build wealth.

Whether you personally are in the market to buy or sell depends on your unique financial situation. Working with a mortgage professional that can give you the facts, explain the current market climate, and guide you in the right direction based on your individual needs is what will allow you to make the best decision. You can contact any of our mortgage professionals today to ask questions, to learn more, or to start the process.